“YOU”

BEFORE ANYTHING ELSE

2020

ANNUAL REPORT

A. CORPORATE POLICY

I. Vision, Mission and Core Values

Vision:

As a partner in nation-building, to be recognized as among the leading rural banks of value to customers, shareholders and employees, continuously striving to create more valued products, achieve greater results and make a positive contribution to the life of every individual.

Mission:

- To encourage the people to practice the habit of savings and thrift and the judicious use of credit in the communities that it serve;

- To help eradicate usurious practices in the communities it serve;

- To provide quality service to the people of the communities it serve whether they are depositors or borrowers so that they can improve their economic standing;

- To enhance the knowledge, skills and community relations of the employees, so they can become good citizens and uplift their economic well-being;

- To encourage the people to be proactive in banking activities so as to spur economic activity in the community, as partners in nation-building.

Core Values:

- Respect

- Excellence

- Responsibility

- Teamwork

- Concern for People

II. Brief History

BRIEF HISTORY

OF PANGASINAN BANK (A RURAL BANK), INC.

Formerly Pangasinan Savings and Loan Bank

In the early part of 1976, a closely-knit circle of friends from San Fabian, Pangasinan informally gathered together and decided to organize the second thrift bank in Pangasinan. The group was composed of Dr. Gregorio Tercero de Guzman, Jr., a private medical practitioner, Atty. Conrado P. Gubatan, at that time Mayor or San Fabian, Mr. Daniel P. Calimlim, an insurance underwriter also engaged in the poultry business, and Mr. Mauro S. Abalos, an accountant and businessman. They invited Msgr. Oscar A. Aquino, who was then parish priest of San Fabian and a native of Mangaldan to join them. With the support of some relative, namely, Dr. Letecia L. Quinto and Mr. Alfredo B. Quinto, related by affinity to Dr. Gregorio T. de Guzman, Jr. and Dr. Loreto J. Gubatan, a dentist and brother of Atty. Conrado P. Gubatan, the group managed to deposit Five Hundred Thousand Pesos (P 500,000.00) with the Central Bank and this amount was the minimum paid-up capital required of a thrift bank at that time.

In August of 1976, the first staff of the bank led by Dr. and Mrs. Gregorio Tercero de Guzman, Jr. underwent a 15-day training at the Central Bank Training Institute. The basic training course was especially designed for employees of savings and loan associations, one of three categories of thrift banks.

With a fully trained staff, the Bank opened on October 3, 1976 on a rented building in Mangaldan, right at the center of business of the town. The Banks name back then was PANGASINAN SAVINGS AND LOAN ASSOCIATION, INC. The blessing was officiated by the late Msgr. Federico Limon, Archbishop of Lingayen-Dagupan with prospective depositors, hundreds of them, in attendance. The guest of honor was the late Mr. Manuel Santos, the Central Bank Director in charge of savings and loan associations.

At the end of 1976, after three months of operation, the Association has exceeded break even and realized a profit of P 137.00. Since then, the Corporation has been profiting except for the troublesome years that followed the assassination of Ninoy Aquino.

One year after the bank’s establishment, due to profitable operation, the Central Bank granted rediscounting privileges and availment of cheap special time deposits (STD) for supervised and non-supervised credit. These privileges expanded the resources of the Bank although most of the time, the Bank did not need loans from the Central Bank due to the rapid increase of deposits from the general public. The Bank has been a pioneer in the financing of cotton industry which flourished in San Fabian and neighboring towns in the eighties. It was in fact one of the biggest financiers of cotton planting in the entire country.

After exactly two years of operation, on October 3, 1978, the Bank opened a Savings Agency, its first branch unit, in San Fabian (which was converted into a full branch in 1990). Then came a rapid succession of branches which were also approved by the CB because of profitable operation and efficient management and strict adherence to all rules and regulations prescribed by the CB. The Malasiqui branch was opened on April 22, 1979, followed by Binmaley branch on June 17, 1979 and the Alaminos Branch on March 3, 1980.

From December 31, 1977 to June 30, 1980, the Bank’s stockholders gradually increased the paid-up capital of the Bank using their hard-earned savings, from P 500,000.00 to P 2 Million to comply with the minimum capital requirement prescribed by the Central Bank. When the Bank had attained the P 2 Million mark, it earned the right to change its corporate name to PANGASINAN SAVINGS AND LOAN BANK, INC. and its new name was registered with the Securities and Exchange Commission.

In 1981, the Central Bank required another round of capital build-up with P 5 Million as the target for savings and loan associations outside of Metro Manila. But due to the economic crisis that started in 1983, the stockholders were not able to comply immediately with the increase in capital. To remedy the situation, the stockholders channeled all available dividends from the undivided profits to stock dividends and the members of the Board of Directors infused back all their per diem and honoraria.

Despite the economic debacle during the martial law years, PSLB maintained a consistent growth in resources and total deposits. In 1980, it was adjudged the First runner-up as Best Savings and Loan Association in the country by the Philippine League of Savings and Loan Associations, with the Central Bank acting as the judge of the contests.

In 1983, PSLB was accredited as a participating or originating bank by the National Home Mortgage Finance Corporation to grant PAG-IBIG housing loans, the only accredited bank in Pangasinan. It was given a continuous automatic revolving line of P 1.5 Million. Since then, PSLB has released about 150 housing loans amounting to about P 15 Million. On December 22, 1984, the NHMFC granted PSLB a P 7.4 Million new credit line, one of the only 38 banks given accreditation.

From P 500,000, the Bank’s resources had reached P 143 Million at the end of 1996. The original stockholders had managed to increase the Bank’s capital to P 10 Million in 1992. But because the CB in 1992 had required all thrift banks operating outside Metro Manila to have a P 20 Million capital, the original stockholders invited S & F Realty Corporation owned by Mr. & Mrs. Romualdo C. Siapno to infuse additional capital.

Finally, the P 20 Million capital requirement was complied with in 1996 only to be increased by the CB (now the Bangko Sentral ng Pilipinas) to P 40 Million. The latest minimum capital requirement for thrift banks is P 52 Million at the end of 2000 and P 64 Million at the end of year 2001.

The present total capital accounts of PSLB is P 44 Million, or P 20 Million short of the required capital. Knowing their limited capability, the present stockholders decided to downgrade the Bank’s category to rural bank. The group had also in mind the greater privileges now being enjoyed by rural banks like lower reserve requirements and easier branching requirements. The Bank will then be able to open branches in Rosario, La Union where it owns a prime lot and in other towns of Pangasinan, and will be eligible also to offer current accounts to its clients. The new name of the Bank as approved by the BSP last January 2001 and by the SEC in August 27, 2001 is now PANGASINAN BANK (A RURAL BANK), INC.

In August 2011, the capitalization of the Bank reached P50 million. Since the bank is over capitalized when it downgraded to rural bank, the bank decided to expand its operation to the north, and in March 26, 2007 the bank opened it’s first branch outside of Pangasinan located at Rosario, La Union.

KEY OF EVENTS

EARLY YEARS:

1976- The bank was organized as the second thrift bank in Pangasinan with a minimum paid up capital of P500,000.00 as a requirement for a thrift bank that time.

August of 1976- when the first staff of the bank led by Dr. and Mrs. Gregorio T. de Guzman, Jr. underwent a 15-day training at the Central Bank Training Institute.

October 3, 1976- when the bank first opened and was then was named PANGASINAN SAVINGS AND LOAN ASSOCIATION, INC.

GROWTH YEARS:

October 3, 1978- the Bank opened a Savings Agency, its first branch unit, in San Fabian.

April 22, 1979- opening of Malasiqui branch.

June 17, 1979- when Binmaley branch was opened.

March 3, 1980- when Alaminos branch was opened.

December 31, 1977- the Bank’s stockholders gradually increased the paid-up capital of the Bank using their hard-earned savings, from P 500,000.00 to P 2 Million to comply with the minimum capital requirement prescribed by the Central Bank.

1980- it was adjudged the First runner-up as Best Savings and Loan Association in the country by the Philippine League of Savings and Loan Associations, with the Central Bank acting as the judge of the contests.

1981- the Central Bank required another round of capital build-up with P 5 Million as the target for savings and loan associations outside of Metro Manila.

1983- as economic crisis was going on, the stockholders were not able to comply immediately with the increase in capital. To remedy the situation, the stockholders channeled all available dividends from the undivided profits to stock dividends and the members of the Board of Directors infused back all their per diem and honoraria.

PSLB was accredited as a participating or originating bank by the National Home Mortgage Finance Corporation to grant PAG-IBIG housing loans, the only accredited bank in Pangasinan. It was given a continuous automatic revolving line of P 1.5 Million.

December 22, 1984- the NHMFC granted PSLB a P 7.4 Million new credit line, one of the only 38 banks given accreditation.

1996- the Bank’s resources had reached P 143 Million from its original resources of P500,000.00.

January 2001- the BSP approved the new name of the bank.

August 19, 2011-the total capitalization reached P50 million

August 27, 2001- the new name of bank is now PANGASINAN BANK,( A RURAL BANK) INC. approved by BSP and SEC.

March 26, 2007- opening of the first branch outside Pangasinan which is located at Rosario, La Union

2008- Pangasinan Bank released its first radio advertisement.

III. Bank’s Business Model and Brand

Pangasinan Bank (A Rural Bank), Inc. is a six-unit bank with Head office located in the agricultural town of Mangaldan, a 1st class municipality in the province of Pangasinan. It has four branches in Pangasinan located in Alaminos, Binmaley, Malasiqui, and San Fabian, and one branch in Rosario, La Union. The Bank funds, comes mostly from deposits comprising of 79% of total resources. These are channeled to loans and due from BSP and other banks comprising 38% and 47% respectively of total resources. Lending activities are mostly for motor vehicle (33.42%), and real estate (28.95%) loans. Other loans are granted to agricultural (17.52%), agrarian (0.19%), trading and commercial (12.70%) sectors and the rest for salary and consumption (7.22%) loans.

The bank faces stiff competition as a number of non-bank financial institutions operate within the same areas of operations, and offer similar loan products without requiring the same documentary requirements ( i.e. KYC and financial documents) and/or collaterals from borrowers. To date, the bank has gradually shift to risk-based lending wherein credit decisions was based primarily on the capacity to pay of the borrowers. The bank has undergone all phases of the Capacity building program conducted by the Small Business Corporation (SBC) to develop risk-based lending.

B. FINANCIAL SUMMARY/FINANCIAL HIGHLIGHTS

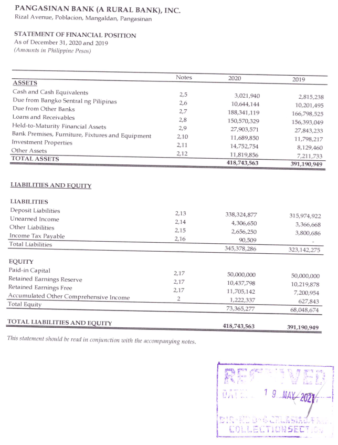

| PANGASINAN BANK (A RURAL BANK), INC. | ||

| Rizal Avenue, Poblacion, Mangaldan, Pangasinan | ||

| STATEMENT OF FINANCIAL POSITION | ||

| For the year ended December 31, 2020 and 2019 | ||

| (In Philippine Peso) | ||

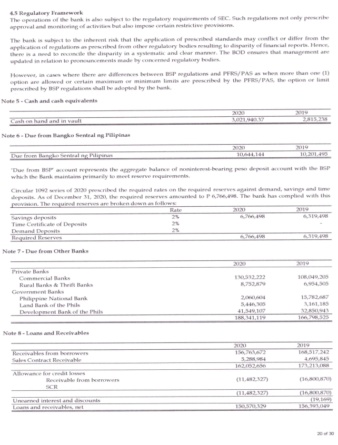

| ASSETS | 2020 | 2019 |

| ASSETS: | ||

| Cash and Cash Equivalents | 3,021,940 | 2,815,238 |

| Due from Bangko Sentral ng Pilipinas | 10,644,144 | 10,201,495 |

| Due from Other Banks | 188,341,119 | 166,798,525 |

| Loans and Receivables | 150,570,329 | 156,393,049 |

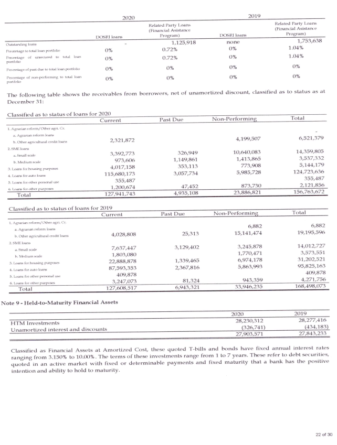

| Held-to-Maturity Investments | 27,903,571 | 27,843,233 |

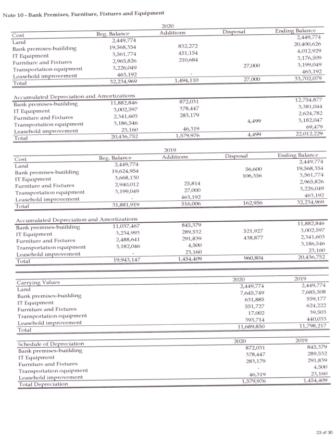

| Bank Premises, Furniture and Fixtures | 11,689,850 | 11,938,772 |

| Investment Properties (ROPA net) | 14,752,754 | 8,129,460 |

| Other Assets | 11,819,856 | 7,211,733 |

| TOTAL ASSETS | 418,743,563 | 391,190,949 |

| LIABILITIES AND EQUITY | ||

| LIABILITIES: | ||

| Deposit Liabilities | 338,324,877 | 315,974,922 |

| Unearned Income | 4,306,650 | 3,366,668 |

| Other Liabilities | 2,656,250 | 3,800,686 |

| Income Tax Payable | 90,509 | 0.00 |

| Total Liabilities | 345,378,286 | 323,142,275 |

| EQUITY: | ||

| Paid-in Stock | 50,000,000 | 50,000,000 |

| Retained | ||

| Earnings | ||

| Reserve | 10,437,798 | 10,219,878 |

| Retained | ||

| Earnings Free | 11,705,142 | 7,200,954 |

| Accumulated Other | ||

| Comprehensive Income | 1,222,337 | 627,843 |

| Total Equity | 73,365,277 | 68,048,674 |

| TOTAL LIABILITIES AND EQUITY | 418,743,563 | 391,190,949 |

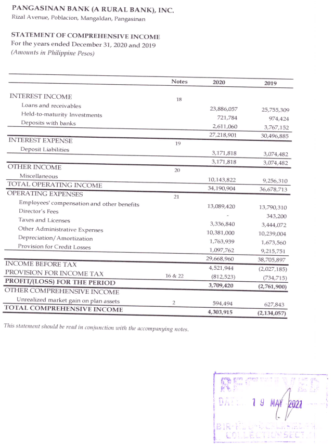

| PANGASINAN BANK (A RURAL BANK), INC. | ||

| Rizal Avenue, Poblacion, Mangaldan, Pangasinan | ||

| STATEMENT OF COMPREHENSIVE INCOME | ||

| For the year ended December 31, 2020 and 2019 | ||

| (In Philippine Peso) | ||

| 2020 | 2019 | |

| INTEREST INCOME: | ||

| Loans and Discounts | 23,886,057 | 25,755,309 |

| Held-to-Maturity Investments | 721,784 | 974,424 |

| Deposits from Bank | 2,611,060 | 3,767,152 |

| Total Interest Income | 26,218,901 | 30,496,885 |

| INTEREST EXPENSES | ||

| Deposits Liabilities | 3,171,818 | 3,074,482 |

| OTHER INCOME | ||

| Miscellaneous Income | 10,143,822 | 9,256,310 |

| TOTAL OPERATING INCOME | 34,190,904 | 36,678,713 |

| OPERATING EXPENSES: | ||

| Employees Compensation and Other | ||

| Benefits | 13,089,420 | 13,790,310 |

| Director’s Fees | 0 | 343,200 |

| Taxes and Licenses | 3,336,840 | 3,444,072 |

| Other Administrative Expenses | 10,381,000 | 10,239,004 |

| Depreciation/Amortization | 1,763,939 | 1,673,560 |

| Provision for Credit Losses | 1,097,762 | 9,215,751 |

| Total | 29,668,960 | 38,705,897 |

| INCOME BEFORE TAX | 4,521,944 | (2,027,185) |

| PROVISION FOR INCOME TAX | 812,523 | (734,715) |

| PROFIT/(LOSS) FOR THE PERIOD |

3,709,420 | (2,761,900) |

| OTHER COMPREHENSIVE INCOME

Unrealized market gain on plan assets |

594,494 | 627,843 |

| NET INCOME AFTER TAX | 4,303,915 | 2,134,057 |

| PANGASINAN BANK, (A RURAL BANK) INC. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rizal Avenue, Mangaldan, Pangasinan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATEMENT OF CHANGES IN EQUITY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the years ended December 31, 2020 and 2019 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In Philippine Peso) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

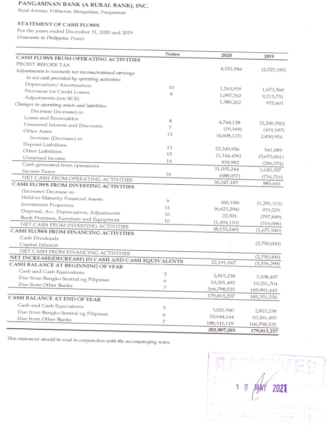

| PANGASINAN BANK (A RURAL BANK), INC. | ||

| Rizal Avenue, Poblacion, Mangaldan, Pangasinan | ||

| STATEMENT OF CASH FLOWS | ||

| For the year ended December 31, 2020 and 2019 | ||

| (In Philippine Peso) | ||

| 2020 | 2019 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||

| PROFIT BEFORE TAX | 4,521,944 | (2,027,185) |

| Adjustments to reconcile net income/retained earnings to net cash provided by operating activities: |

||

| Depreciation/Amortization | 1,763,939 | 1,673,560 |

| Provision for Credit Losses | 1,097,762 | 9,215,751 |

| Adjustments (see SCE) | 1,389,262 | 975,601 |

| Changes in Operating Assets and Liabilities: |

||

| Decrease(Increase) in: | ||

| Loans and Receivables | 4,744,128 | (5,200,590) |

| Unearned Interest and Discounts | (19,169 | (419,187) |

| Other Assets | (4,608,123) | 2,830,954 |

| Increase(Decrease) in: | ||

| Deposit Liabilities | 22,349,956 | 541,089 |

| Other Liabilities | (1,144,436) | (5,673,061) |

| Unearned Income | 939,982 | (296,574) |

| Total Cash Generated from Operating | ||

| Activities | 31,035,244 | 1,620,357 |

| Tax Paid | (688,057) | (734,716) |

| Net Cash from Operating Activities | 30,347,187 | 885,641 |

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||

| (Increase) Decrease in: | ||

| Held to Maturity Financial Assets | (60,338) | (1,291,315) |

| Investment Properties | (6,623,294) | 933,229 |

| Disposal, Acc. Depreciation, | ||

| Adjustments | 22,501 | (797,849) |

| Bank Premises, Furniture and | ||

| Equipment’s | (1,494,110) | (516,006) |

| Net Cash from Investing Activities | (8,155,240) | (1,671,940) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||

| Cash dividend | 0 | (2,750,000) |

| NET INCREASE (DECREASE) IN CASH | ||

| AND CASH EQUIVALENTS | 22,191,947 | (3,536,299) |

| CASH BALANCE BEGINNING OF THE YEAR |

||

| Cash and Cash Equivalents | 2,815,238 | 3,108,407 |

| Due from Bangko Sentral ng Pilipinas |

10,201,495 | 10,251,704 |

| Due from Other Banks |

166,798,525 | 169,991,445 |

| 179, 815,257 | 183,351,556 | |

| CASH BALANCE AT END OF YEAR |

||

| Cash and Cash Equivalents | 3,021,940 | 2,815,238 |

| Due from Bangko Sentral ng Pilipinas |

10,644,144 | 10,201,495 |

| Due from Other Banks | 188,341,119 | 166,798,525 |

| 202,007,203 | 179,815,257 | |

C. FINANCIAL CONDITION AND RESULTS OF OPERATION

President’s Annual Report for 2020

The Bank started off the year 2020 on a positive note generating income in the first two months of the year bouncing back from last year’s negative performance. The momentum however was slowed down in the months that followed due to the crisis – a once-in-a-generation outbreak of a highly contagious disease that turned into a pandemic affecting the entire world. In March, President Rodrigo Duterte signed Republic Act 11469 or “Bayanihan To Heal As One Act” into law declaring a national health emergency throughout the Philippines as a result of the COVID-19 situation. The law authorized the President to adopt temporary measures in order to respond to the crisis brought about by the pandemic. The entire Luzon was placed under Enhanced Community Quarantine (ECQ). Only private establishments providing basic necessities including banks were allowed to open. Classes and school activities in all levels were suspended, mass gatherings were prohibited, strict home quarantine was to be observed in all households, work from home arrangements were implemented. Mass public transport facilities were suspended and land, air and sea travels were restricted.

Responding to the emergency situation and most importantly to protect our employees from the possibility of contacting the virus, the Bank implemented the following temporary measures with regular monitoring by the BSP:

- Skeletal Workforce (a 3-day work-week for every employee);

- Shortened banking hours (8:30 am to 12:30 pm) ;

- Carpooling and subsidized lodging to 3 of our employees in Alaminos and Rosario ;

- Subsidized lunch as there were no canteen or restaurants opened;

On April 1, 2020, the Bangko Sentral ng Pilipinas (BSP) issued Memorandum No. 2020-17 which mandates that all covered institutions, banks included, shall implement a thirty (30) day grace period for all loans with principal and /or interest falling due within the ECQ period without incurring interest on interest, penalties, fees and other charges. The initial thirty (30) days grace period shall automatically be extended if the ECQ period is extended by the President pursuant to his emergency power under the Act. The Bayanihan Act to Heal as One lasted until May 31, 2020.

During the period of ECQ there was not much that we could accomplish in terms of marketing for new loans or collecting on problem loans for obvious reasons. Mobility was a big problem because of the suspension of mass transport facilities, and because checkpoints were positioned almost everywhere. The people’s priorities were focused more on the basic necessity which is food. Every day people were lining up in grocery stores and even going to the public markets is scheduled for every barangay. There was also an instance when employees in San Fabian branch were placed under a 14 day quarantine because of possible exposure from the virus. Even Malasiqui branch temporarily closed its operation from March 23-31 because of the executive order no. 0015-2020 ordering the Municipality of Malasiqui residents not to leave their respective residences and were ordered to be on home quarantine. The Regular Board meetings resumed only in June via the application Zoom.

When Pangasinan was placed under General Community Quarantine (GCQ) in June 1, the bank’s operations partially returned to normal operating on a full force manpower but still with shortened banking hours, car pool and partially subsidized lodging for the 3 employees living far from their assigned branch. During this time, new loans started to come in mostly from front liners availing of the bank’s auto loan product. And since these front liners are considered high risk we required them to get a mortgage redemption insurance (MRI) or, if they have an existing life insurance policy to endorse the policy in favor of the bank up to the extent of the loan balance to somehow mitigate the risk.

On September 18, 2020, the BSP issued Memorandum No. M-2020-074 which provides for the implementation of Section 4 of the Republic Act No. 11494 otherwise known as the “Bayanihan to Recover as One Act” (Bayanihan 2 Act). The memorandum mandates all BSP Supervised Financial Institutions (BSFI’s) to implement a mandatory one-time 60-day grace period to all loans that are existing, current and outstanding as of September 15, 2020 and falling due on or before December 31, 2020. During the mandatory 60-day grace period, BSFI’s shall not charge or apply interest on interest, penalties, fees and other charges and thereby extending the maturity of the loans.

With all the happenings brought about by this pandemic, the bank did not forget its role in helping the community by donating to the relief operations of the church, donating to the front liners assigned at checkpoints for the purchase of protective gears and taking part in the distribution of the Special Amelioration Funds (SAP) to more than 10,000 beneficiaries in the town of San Fabian.

Back in 2019, the Board of Directors (BOD) started scouting for a new service provider for its cloud-based core banking solutions and mobile banking in preparation for the bank’s digitization. Due to the pandemic however, the move was temporarily halted although the directors have already attended presentations conducted by the following service providers: Pearl Pay and IComputing Solutions, Inc, (ICSI). The Oradian has also conducted a webinar presentation to senior management. To date, the BOD are still carefully evaluating the pros and cons of each company and are still open to discussion with other providers. We are also looking into the possibility of retaining the services of our existing provider which is the Byte per Byte should there be improvements or upgrades on their products and services.

As for the need for a BSP accredited Retail Payment Platform, the BOD chose Union Bank’s UBX i2i services. Their services include Bills Payment, Domestic Transfer, Insta Pay, Mobile ATM, Mobile Scoring, PESO Net, U-Transfer, Wallet Transfer, all these for free. No set-up cost, no subscription and with revenue sharing and electronic on-boarding. We are hoping for its full implementation within the first half of 2021.

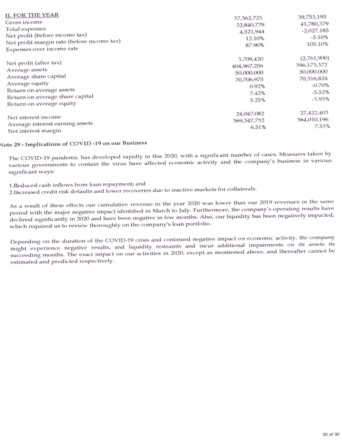

In spite of the pandemic, the BOD, Senior Officers and staff worked hard to come up with a positive performance for the year, increase the resources, deposits, capital funds, liquid assets, earnings per share and significantly reduce the expenses and past due ratio as shown in the Financial Performance for the year 2020 as per following financial data and with their corresponding explanations:

| % of Increase | |||

| (Decrease) | 2020 | 2019 | |

| FOR THE YEAR (In Thousand Pesos) | |||

| TOTAL INCOME | -6.01% | 37,363 | 39,753 |

| TOTAL EXPENSE | -21.05% | 33.005 | 41.804 |

| NET INCOME | 312.48% | 4,358 | (2,051) |

| AT YEAR END (In Thousand Pesos) | |||

| RESOURCES | 6.60% | 423,247 | 397,042 |

| LOANS | -6.97% | 156,764 | 168,517 |

| DEPOSITS | 7.07% | 338,325 | 315,974 |

| CAPITAL FUNDS | 5.69% | 72,599 | 68,693 |

| LIQUID ASSETS (Cash and Other Cash Items, Due from BSP, Due from Other Banks) | 12.34% | 202,007 | 179,815 |

| RATIOS | |||

| EARNINGS PER SHARE | 312.68% | 8.72 | -4.1 |

| PAST DUE RATIO | -24.20% | 18.39% | 24.26% |

| CAPITAL ADEQUACY RATIO (CAR) | -5.04% | 16.77% | 17.66% |

Total Income decreased by 6.01% or P 37.363 Million compared to last year’s P 39.753 Million. As usual the administrative department particularly the Asset Management contributed the highest gross income of P 11.788 Million coming from the sale of acquired assets.

Total Expenses went down by 21.05% or P 33.005 Million compared to last year’s P 41.804 Million. The significant decrease was due to the booking of allowance for credit losses in 2019 of P 9.224 Million and the reversal of Allowance for Credit Losses (ACL) in 2020 of 1.089 Million contributing to a favorable variance of P 10.313 Million.

Net Income this year increased by 312.48% or P 4.358 Million compared to last years’ net loss of P2.051 Million. Alaminos, Mangaldan, San Fabian, Binmaley and Admin contributed a total of P 6.357 Million in total net income, while Malasiqui and Rosario combined for a net loss of P 1.999 K.

Total Assets increased by 6.60% or P 423.247 Million compared to last years’ P 397.042 Million. The increase was due to funds from the expansion in deposits and the net income for the year.

Total Loans decreased by 6.97% or P 156.764 Million compared to last years’ P 168.517 Million. The slowdown may be attributed to the effect of the pandemic, because people were wary of applying for loans. Moreover, the bank temporarily suspended granting of loans mostly to employees, OFW’s and business owners affected by the pandemic during the ECQ period. Another reason is the full payment of a large account and the transfer of a large account to Real and Other Properties Acquired (ROPA) account.

Deposits increased by 7.07% or P 338.325 Million compared to last years’ P 315.974 Million brought about by the growth in deposits coming from Malasiqui, Mangaldan, Rosario and San Fabian branches with a combined total of P 22.987 Million.

Capital Funds increased by 5.69% or P 72.599 compared to last years’ P 68.693 mainly contributed by the net income for the year of P 4.358 Million.

Liquid Assets improved by 12.34% or P 202.007 Million compared to last years’ P 179.815 Million. Liquidity ratio for this year is 82.753% which means that our bank is very much liquid.

Earnings per Share this year went up by 312.68% or P 8.72/ share compared to the negative P 4.1/share last year. This favorable factor is a direct consequence of our positive result in our bottom line.

Past Due Ratio decreased by 24.20% or 18.39% compared to 24.26% in 2019. The decrease was mainly due to the collection of a large delinquent account and the transfer of a large delinquent account to ROPA account following its foreclosure. This means that despite the decrease in total loan portfolio, the bank did well in the collections of past due accounts.

Capital Adequacy Ratio decreased by 5.04%. However it remains substantial at 16.77% compared to last years’ 17.66%. This indicates the banks strength in its capital structure. The set standard or the industry level is at 10%.

Based on the above financial performance almost all indicators improved compared to last year’s performance except for Total Income, Total Loans and Capital Adequacy Ratio. With the ACL in place and strictly being monitored, we hope that we would no longer repeat what happened last year when we booked a one-time huge amount of ACL that severely affected the bank’s performance in 2019.

Lastly, the BOD declared a 7% cash dividends to all common shares and 10% cash dividends to all preferred shares for all stockholdings on record as of December 31, 2020. The BOD has approved the implementation of Article XI of the Amended By-Laws on the Distribution of Net Earnings of the Bank. For the first time, the BOD will be receiving 5% share in the net profit to be shared equally and likewise a similar 5% share in the net profit to the Executive Officers to be distributed in such manner as the Board may provide. With the declaration of cash dividends, our employees will also get their 5% share from the Net Income as provided for in the CBA.

With these, I thank you, the stockholders for your continued confidence in the Board of Directors and Senior Management. We promise to work hard for you to make our next year even better than the last.

ANNE Q. DE GUZMAN

President

D. RISK MANAGEMENT FRAMEWORK ADOPTED

RISK MANAGEMENT is a system that needs to be put in place in a business, in order to understand and calculate the risks being taken in exchange for earnings or revenue. It considers and determines the probability of a negative event; of a crisis; of an NPL; of a default and of a loss. It helps the Board and the Management to formulate risk-sensitive decisions. It must not become a barrier towards delivering exceptional services to its clients. Neither shall it be viewed as an additional surface for red tape or a front to appease the regulators.

RISK MANAGEMENT OBJECTIVES & PROCESSES

- IDENTIFY: to search for and locate the various risks before they become problems.

- ASSESS/MEASURE: evaluate its impact or consequence and the probability of the risks happening or taking place

- MONITOR: observe/study/keep an eye on the risk marker/risk indicator as well as the risk limits set and the mitigation plans set in place

- CONTROL: check for and make correction for deviations versus the internal control systems and the risk mitigating plans

- REPORT: Supply or furnish information and feedback on the various risk activities, current/existing risks and emerging risks.

In addition to the above, there is a need to:

- Define and disseminate risk orientation/familiarization training and policies set in writing

- Develop the risk management system and its control foundations

- Institutionalize the risk management process. To make it as the code of practice/a habit, a fixture in the company.

FOUR GUIDING QUESTIONS IN RISK MANAGEMENT:

- R – Return. Are we gaining an appropriate return for the risk we are taking?

- I – Immunization. Do we have the necessary controls in place, to lessen the risk losses?

- S – Systems.Do we have the actual system to measure and manage the various risks we face?

- K – Knowledge. Do we have the right people, sufficient skills, suitable culture, and proper values for an effective risk management?

RISK as DEFINED:

It is the uncertainty of whether events expected or otherwise, will have an adverse impact on the bank’s capital or earnings. It is an inevitable part of the business of Banking.

The Bank Risk Spectrum:

The wide range of risks faced by a Bank is generally grouped into:

- Credit risk – estimated to be 54% of the risk range:

- Operations risk – approximately 27% of the risk band;

- Market risk – composing the remainder of the 19% portion.

Market and Credit risks are faced and experienced primarily in the hope of ample rewards or good returns. A portion of the bank’s capital addresses the potential losses resulting from these risks.

Operational risk is taken unintentionally and it is a cost of doing business.

VARIOUS RISKS THAT BANKS FACE

- Market Risk – the risk of loss, immediate or over time, due to adverse fluctuations in the price or market value of instruments, products, and transactions in the bank’s overall portfolio-whether On or Off Balance sheet.

It is influenced by:

- Interest Rate Risk – the bank’s financial condition is exposed to adverse movements in interest rate. It means that changes in interest rate will reduce the current or future earnings and/or the economic value of capital of a

Financial Institution. - Foreign Exchange Risk – possibility that movements in exchange rates may adversely affect the value of the company’s holdings, thus, its financial condition.

Areas of market risk may include the following:

- Risk of decline in value of trading accounts and investments due to fluctuations in market prices

- Risk that issuer may not be able to meet its obligations promptly

- Risk of decline in value of investments due to investment decisions which fail to take into account:

- marketability of investment instrument. If bank cannot wait to hold on to the investment until maturity, there must be many buyers in the market willing to pay at a price that is close to bank’s acquisition cost so that bank will not incur a loss

- diversification of investment outlets

- maturity and rate of return

- type of issuer (to ensure payment on maturity)

- BSP regulations on limits and ceilings

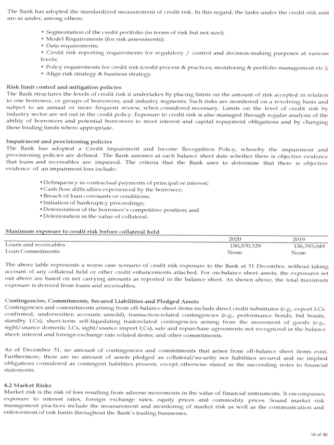

2. Credit Risk – the risk to earnings or capital from the likelihood that a borrower or counterparty will fail to perform/make good on an obligation. It is the most recognizable risk in relation to the banking business.

Credit risk events which will burden on a bank’s bottom-line:

- the need for loan loss provisioning

- a dramatic increase in NPLs

- a rapid rise in ROPA

Areas of credit risk may include the following

1. Risk of poor or non-collection of loans

- borrower does not have the capacity to pay as shown by financial statements, income tax returns, statements of assets and liabilities, credit investigation, or such other credit basis.

- borrower belongs to a distressed industry

- borrower’s loan grant is beyond his approved credit limit

- corporate borrower has doubtful paying capacity because its capitalization is minimal in relation to loan or project to be financed

- borrower’s co-makers, endorsers, sureties and/or guarantors in case of unsecured loans, do not possess good credit standing and are not financially capable of fulfilling their commitments to the bank in case borrower fails to do so.

- borrower’s loan is in excess of loan value of his submitted collaterals.

- borrower’s loan repayment plan does not jibe with his cash flows

- borrower’s loan was approved and released without proper approval or beyond the lending authority of officers or with incomplete signatories on loan documents or with incomplete documentation or with collateral deficiency such as unregistered REM and chattel mortgage.

- borrower was able to renew his loan without 20% reduction in his principal obligation or without submitting updated financial statements/income tax returns.

- Deficiencies associated with operations risks such as

- lack of or inadequate review of loan portfolio to assess quality and adequacy of loan loss provisioning

- absence of early warning system to detect/recognize symptoms/indicators of problem accounts

- absence of or inadequate loan supervision – monitoring of maturing or matured loans, periodic, visitation of the borrower or borrower’s place of business; updating of credit information

- absence of reminders to borrowers to pay maturing and past due obligations

- ineffective monitoring of insufficient post-dated checks to cover monthly amortizations of borrowers

- poor monitoring of status and value of collateral

- lack of equipment support to keep track of collectibles and actual collections

- absence of collateral valuation and review, collection, credit review, and loan loss provisioning

- lack of periodic review to determine if existing policies are still compatible with the changing market conditions

2. Risk of excessive credit to a single borrower/group of borrower vis-à-vis the single borrower’s limit (SBL).

3. Risk of concentration of credit to a single industry

- grant of loans by type/industry i.e., consumer loans, real estate loans, is not diversified and exceeds the 30% benchmark

4. Risk of overexposure to DOSRI and self-dealing practices

- disregard of aggregate and individual ceilings prescribed by Bangko Sentral ng Pilipinas

- Indiscriminate granting of loans to corporations and individuals identified with DOSRI, although not falling within the technical description of DOSRI

3. Operations Risk – the risk to earnings or capital arising from problems with service or product delivery.

Its occurrence is influenced by the following factors:

- internal control

- information system

- employee integrity

- operating processes

Sub-categories of Operations Risk are:

1. Transaction risk – risk of loss due to some failures in processing of transactions or problems in the delivery of bank services. This may consist of:

- Documentation risk – risk of loss arising from incomplete or incorrect documentation of the transaction.

- Exceeding limits – risk of loss arising as a result of limits being exceeded and the need to reduce the excess.

- Fraud – risk of loss arising from either internal or external fraud within the organization.

- Security risk – risk of loss from all manner of security breaches including allowing competitors access to confidential information

- Key personnel risk – risk of loss due to having only one person with vital risk management skills or knowledge

- Processing risk – risk of loss due to failings or errors in manual processes usually associated with the quality of back – office staff.

- Systems error – risk of loss due to a failure in any of the systems used within the bank.

- Management information risk – risk of loss arising from management making decisions based on inaccurate or incomplete information.

- Information technology system failure – risk of loss arising from a failure in the computer systems

Areas of operations risk may include the following:

a. organization that is not appropriate to the size and activities of the bank or not flexible to meet changes in business conditions

b. duties and responsibilities of the board of directors, senior management, the officers and staff that are not clear and properly delineated

c. reporting lines that are not clear

d. responsibilities that are not segregated nor distinguished as to those committing the organization to a transaction, recording it, settling it, and controlling it

e. appointed officers who are not qualified to manage the bank

f. ineffective supervision of the bank’s affairs

g. BOD and senior management who are not generally informed of the bank’s business environment and the legal and regulatory framework controlling the bank’s activities or who do not devote enough time and attention in overseeing the bank

h. Lack of or inadequate risk management system

i. Non-compliance with minimum internal control standards particularly on

- maintenance of proper accounting records and adoption of written accounting policies and procedures

- independent balancing

- division of duties and responsibilities

- joint custody

- signing authorities

- dual control

- number control

- rotation of duties

- independence of the internal auditor

- direct verification

j. Absence of internal audit personnel/department to make certain that controls to protect assets are maintained, or in the absence of controls, to propose adequate and effective control system and procedures

k. Management reports that are not timely, inaccurate and incomplete as to information

l. Lack of management reports to the board and senior management on the financial condition and performance of the bank which will be helpful in the formulation of policies and plans

m. Absence of feedback mechanism on adherence to set policies, standards and procedures on major activities of the bank

n. Lack of downward and upward flow of communication within the bank

o. Non-utilization of external and internal audit reports as well as BSP recommendations on examination findings to improve performance

4. Liquidity Risk – the risk to earnings or capital arising from the Bank’s inability to make a timely payment/meet any of its currently maturing financial obligations to customers or counter parties in any currency.

Such risk may arise as a result of:

- Mismatches in cash flows

- Borrowing short and lending long

- No provision for reserves (primary reserves to meet anticipated cash needs while secondary reserves to meet contingent or extraordinary cash needs/withdrawals)

- Absence of contingency plan to cover unexpected fund withdrawals during financial stress

- Absence of or non-compliance with maturity gap limits

- High incidence of past due loans which put pressure on bank’s liquidity position (on time loan collections, assure a steady source of funds/cash flows)

5. Compliance Risk – is the risk to earnings or capital arising from violations of or non-conformance to laws, rules, and regulations, prescribed practices or ethical standards. It exposes the Bank to fines, penalties, damages, and the voiding of contracts.

6. Legal Risk – is the risk to earnings or capital that may arise as a result of unenforceable contracts, lawsuits, or adverse judgment.

Areas of legal risk may include:

- Contracts that are not legally enforceable due to failure to carefully review all provisions therein.

- Protracted legal/court case

7. Reputational Risk – is the risk to earnings or capital arising from the possibility that negative publicity regarding an entity’s business practices (whether true or not) will cause a decline in the customer base, cost of litigation or revenue reductions.

8. Personnel Risk – is the risk to earnings or capital arising from inadequate training, inexperience, or illegal activities of a risk-taking personnel. It highlights the human side of risk-taking and the important role and adequacy of institutional guidelines/manuals, codes of conduct, personnel policies and training and development programs.

9. Strategic risk – risk to earnings or capital arising from adverse business decisions or the improper implementation of these business decisions.

FACTORS/EVENTS THAT CHALLENGE RISK MANAGEMENT

1. Those that are bought about by Market Place or Economic change

2. Change that are due to Technology Improvements or due to Process Change

3. Change that come about because of New Strategies introduced

4. Change because of Competition bringing in

- new products

- new channels

5. Change within the company itself due to:

- product change

- new leadership or shift in organizational structure

6.Change to comply with new Regulation or Legislative enactments.

AUTHORITIES and RESPONSIBILITIES

- The Board of Directors must define the policy structure and lay down the risk management framework. Towards this end, it must:

- approve the policies for the various key risks;

- set-up the risk management foundation

- identify who shall be responsible for carrying out the policies,

- originate controls to comply with the policies

Additionally, the BOD must establish and guide the Bank’s strategic direction and the tolerance towards risks. It must periodically review, discusses, and approve needed changes to address the overall objectives in relation to the acceptable level of liquidity and market risks.

It must set the limits, which indicates its maximum tolerance for each major risk. The limits structure is vital for interest rate risk; credit risk; liquidity and operational risks. Relatedly, there must be exposure measurement mechanism in place to properly quantify the limit structure so established.

The BOD must also ensure that technical and human resources are allocated towards risk management. There must be a personnel available who possess technical skills to evaluate and control risks. There must be continuous training of personnel and that the internal audit function is properly manned by a staff with competent background.

It must monitor risks, ascertaining that the levels of risk is maintained with the tolerance limits which is properly supported by adequate capital base.

The BOD shall exercise its oversight function in risk management by seeing to it that:

- set policies are being followed;

- set limits are being properly considered

- controls are in place

There must be timely reporting and clear presentation when there are noted breaches to the established limits so that thoughtful, well-informed, and properly coordinated risk management decisions are formulated and timely actions are undertaken in a timely manner.

II – Senior Management for its part must develop and implement the risk management policies, procedures, and practices. There must be periodic review of the Bank’s risk management policies and procedures to make sure that they remain appropriate and reliable. It must make certain that the lines of authority and responsibilities are being strictly followed.

It is the “implementor”; it shall be responsible for carrying out the risk management decisions, under a system of delegated authorities. In carrying out this mandated authority, it shall be subject to close monitoring and control that the BOD has set up.

Other related functions of senior management in risk handling are the following:

- maintenance of appropriate limits structure as well as the presence of adequate measurement systems;

- to oversee the implementation and proper upkeep of management information system (MIS);

- the establishment of an effective internal controls;

- Make sure that adequate resources are available.

E.CORPORATE GOVERNANCE

I. Selection Process for the Board and Senior Management

The director who shall be elected at the annual meeting of the stockholders shall hold office for a term of one (1) year and until their successors shall have been duly elected and qualified.

II. Board’s Overall Responsibility

In general, the Board shall have full charge of all the properties, interest, business and transactions of the Corporation, with full power and authority, to manage, direct and supervise the same, which powers shall include, but shall not limited to the following:

- To elect or appoint all officers and employees of the Corporation; to fix their salaries, wages, and other conditions of employment, and to discipline or remove them; but every executive officer of the Corporation and such other officers as the Board may authorize shall have the power to suspend any subordinate officer or employee under his supervision, the suspension to continue until the Board shall have acted upon the case.

- To appoint agents, correspondents and depositories, and to designate the points where they are to be situated, subject to the pertinent provisions of existing laws and rules and regulations.

- Subject t the authority of the Monetary Board of the Bangko Sentral ng Pilipinas, to authorize the establishment of branches at such places as will serve the interest of the public and that of the Corporation.

- To pass upon all applications for credit accommodations as well as important contracts and agreement, subject to the pertinent provisions of existing laws, rules and regulations governing rural banks.

- To fix rates of interest on loans as well as deposits in conformity with existing rules and regulations.

- To delegate to the Chairman of the Board, Vice-Chairman, President, or any officer or to any committee any of its delegable powers whenever deemed necessary for the best interest of the Corporation.

- To prescribed from time to time, the powers and duties and fix the compensation of the officer, agents, and employees of the Corporation in the management of its properties and affairs, where such powers and duties are not prescribed by law or by the By-Laws.

III. Description of the Role and Contribution of Executive, Non-Executive and Independent Directors, and of the Chairman of the Board.

1. THE CHAIRMAN. The Chairman of the Board shall preside at all meetings of the Board of Directors, in his absence or inability to do so, the meeting shall be presided over by the Vice Chairman, or other Officers to whom this power may have been delegated by the Chairman. The Chairman of the Board shall have such other powers as may be prescribed by the Board.

2. THE VICE CHAIRMAN. The Vice Chairman shall have such powers and perform such duties as the Board of Directors may from time to time prescribe and as may be delegated to him by the Chairman. In the absence of the Chairman, the Vice Chairman shall act in his stead and shall perform any and all such powers and duties pertaining to the office.

3. THE PRESIDENT. The President who shall be elected from among the Directors, shall be the Chief Executive officer of the Corporation. Aside from those which may have been assigned to him by the Board, his powers and duties shall include the following:

- To direct the implementation of the policies of the Board, and report to it and the stockholders on all matters concerning the affairs of the Corporation that may require action by them at their respective meetings.

- To take active supervision and control over the property, interest, business and affairs of the Corporation, and subject to the approval of the Board, he may appoint, suspend or remove any appointive officer or employee whenever in his judgment it may become necessary to do so.

- To supervise, control and direct subordinate officers, agents and employees in the discharge of their duties.

- To see to it that all officers, agents, employees, and other personnel comply with the pertinent laws, as well as the applicable rules and regulations of the Bangko Sentral ng Pilipinas and all other regulatory/supervisory bodies.

- To present to the Board of Directors at any regular or special meeting or at such other times as it may require, a report on the state of the business of the Corporation.

- To attend meetings of the Board, and render such assistance or advice as it may concerning the estate of the business of the Corporation.

- To be responsible for the efficient management of the affairs of the Corporation, to maintain harmonious relations between management and the employees, see to it that the public in general, and the clients of the corporation in particular, are rendered prompt, courteous and efficient service, and to develop and maintain sound public relations.

- The President may delegate to any officer any of his powers and duties whenever in his judgment such delegation is expedient and practicable.

4. THE VICE PRESIDENT. The Board of Directors may elect one or more Vice Presidents who may not be members of the Board, whose powers and duties, in general, shall be determined by the Board. In the absence or inability of the President, the Board shall designate the Vice President, who should be a member of the board of directors, to perform and discharge the powers and duties of the office of the President. If the Vice Presidents are not members of the Board, the Board shall designate who among the Board members shall act in place of the President.

5. THE TREASURER. The Treasurer shall have the care and custody of the funds, securities and properties of the Corporation. He shall deposit all money and valuable effects in the name and to the credit of the Corporation in such banks, or trust companies, or with such bankers or other depositories as the Board may from time to time designate, and any funds so deposited shall be withdrawable only by checks or other instruments signed by duly authorized officers of the Corporation as hereinafter provided. He shall render to the Board of Directors and the President whenever required, an account of the financial condition of the Corporation and of all his transactions as Treasurer. He shall perform such other duties as the Board of Directors may from time to time assign t him or are incident to his office. In the absence of the Treasurer, or his inability to act, his duties shall be performed by such person as may be designated by the Board of Directors.

6. THE SECRETARY. The Secretary who must be a citizen and resident of the Philippines, shall have the following powers and duties:

- He shall keep accurate minutes of all meetings of the stockholder and of the Board, and shall attend to the giving of all notices required by these By-Laws to be given;

- He shall be custodian of the corporate seal, stock certificate books, stock and transfer book, records, documents and papers of the Corporation, prepare ballots for the annual elections and keep a complete and up-to-date list of the stockholders and their addresses;

- He shall perform such other duties as may be assigned to him from time to time by the Board of Directors of the President, and such other duties incidental to his office;

- He shall also sign prepare such reports and statements as are required by the Board and or the President.

- During the absence or inability of the Secretary, the Board shall select the persons to act in his stead.

7. GENERAL MANAGER/CHIEF OPERATING OFFICER. (The position in place instead of Comptroller, as amended on 01-25-11 and confirmed on 02-13-11). The General Manager/Chief Operating officer shall be the operating head of the bank with the power to transact the general business of the bank. He is responsible for the efficient and accurate execution of what the board of directors decide upon. He supervises all the transaction between the bank and customers through junior officers and employees. He provides leadership and has to control the work of others. He has to ensure that the best results are obtained from his own efforts and from those bank officers and bank employees, he has tasked for being responsible.

In essence, the duties of the general manager are as follows:

- Plan, organize, coordinate and control all the financial and administrative activities of the bank and to direct and supervise the detailed operations of the bank.

- Establish and maintain adequate accounting system, provide periodic financial and operating statements, and prepare budgets as prescribed by the board of directors.

In specific terms, the duties of the general manager are as follows:

- Approve loan applications up to the amount delegated to him.

- Recommend the approval or disapproval of loan applications in excess of the amount he could give to the credit committee.

- See to it that all books of accounts are up-to-date and in balance.

- Sign or countersign checks or demand drafts when authorized by the Board of Directors.

- See to it that an effective internal control system is installed and maintained in order to prevent errors and frauds from being committed.

- Supervise the granting of loans, as well as follow up the collection of accounts either in writing or in person and see to it that past due items, if any, are within manageable levels.

- Approve payrolls as well as any disbursements for expenditures and release of loan proceeds.

- See to it that all exceptions noted in the audit and examination of the books and operations of the bank conducted by the Bangko Sentral ng Pilipinas personnel and other supervisory bodies are corrected in accordance with the instructions received.

- Certify such statements of financial condition, income statements, reports, records and statistics as may be required by law, by the Monetary Board or requested by the President or the Board of Directors.

- Initiate and enforce measure and procedures relating to all accounting matters including clerical and office methods, records, reports to the end that the business of the Corporation shall be conducted in accordance with law, lawful rules, regulations and directories of the Bangko Sentral ng Pilipinas and with the maximum safety, efficiency and economy.

- Act as a budget director, and in conjunction with the other officers and heads of departments, to prepare an annual budget covering all activities of the Corporation, and t submit the same t the Board before the calendar year begins.

- Attend meetings of the Board of Directors and the standing committees when so required by the Chairman or the Board and to render such assistance and advice as the Chairman, President or Board may desire concerning the books, accounts and system of financial transactions of the Corporation, of all its branches, and of any person, entity or Corporation in which the Corporation may be interested.

- In case of any defalcation, default, or dereliction of duty coming to his knowledge at any time, to notify at once the Chairman and the President

- In the absence of the General Manager or his inability to act, his duties shall be performed by such person as may be designated by the Board.

8. COMPLIANCE OFFICER. (Installation of Compliance Officer, as amended on 01-25-11 and confirmed on 02-13-11). It is the bank’s discipline to stay compliant with regulations on a going-concern basis that is essential to what makes it a bank. His/her duties and responsibilities shall include the following:

- In consultation with the Board of Directors and Board Officers, prepares a Compliance Program for approval of the Board, and thereafter, submit the same to the DRB, BSP.

- Oversee and coordinate with the Board and Bank President the implementation of Compliance Program.

- Acquaint the Board members and the bank personnel with the provisions of the Compliance Program.

- Conduct regular updates orientation of the latest issuances, policies rules and regulations issued by the regulatory institutions (BSP, PDIC, SEC, BIR, DOLE, SSS, DOF).

- Build-up library of all relevant laws, rules, and regulations issued by regulatory bodies.

- Keep the library current and up-to-date be seeing to it that copies of new laws and issuances of regulatory bodies, interpretations thereof, amendments thereto and repeat revocation thereof are on file and properly disseminated to the officers and employees of the bank.

- Study each new law, rule or regulation with the following objectives: (a) determination of the unit/group/department and personnel affected; (b) providing proper implementation guideline; (c) identification of the risk of non-compliance thereof.

- Provide a vehicle for efficient dissemination of issuances, laws, rules and regulations: (a) install system with which permanent laws, rules and regulations together with their implementing guidelines and the risks/consequences for non-compliance thereof are effectively disseminated to acknowledged, and clearly understood by each and every staff member of the bank; (b) conduct regular meetings and seminar/workshops among the officers and staff on the proper implementation of the guidelines and risk implications; (c) maintain a bulletin board and regularly post new issuances/implementing guidelines for the information and guidance of all concerned; (d) adopt an open communication system; (e) free flow of information should be maintained and compliance related issues should be conveyed in a complete and timely manner; (f) compliance issues should be brought to the attention of the staff concerned as soon as possible for immediate resolution in order to minimize risks/violations thereof.

- Regularly consult with appropriate regulatory agencies for additional guidance on specific provisions of laws, rules and regulations and/or discuss compliance findings with each agencies, initiate dialogues regarding borderline issues.

- Conduct annual competence assessment, future training needs and introduce remedial action to correct/improve inadequate performance.

- Install compliance monitoring system in coordination with the Audit Committee or Bank President to insure that the directors, officers and staff are familiar with the compliance program.

- Undertake periodic compliance review/monitoring and assessment of each department/branch on a regular basis.

- Compliance officers should consult internal and external auditor of any violation of laws, rules and regulation noted in their findings.

- Compliance Officer shall submit reports on the monitoring and assessment to the President/Chairman of the Board of Directors to document findings, issues, concerns and remedial/corrective measures taken which report must be cleared and approved by the department/unit head/branch managers before submitting the same to the officers concerned.

- The Compliance Officer shall closely and religiously monitor the following: (a) past due loans; (b) non-performing loans; (c) aging of loans.

- The Compliance Officer should be familiar with the types/kinds of risks the Bank is exposed to which are as follows: (a) credit risk; (b) market risk; (c) interest risk; (d) foreign exchange risk; (e) liquidity risk; (f) operational risk; (g) legal risk; (h) compliance risk.

- The Compliance Officer should be acquainted with the manner CAMELS is computed/evaluated: (a) capital adequacy; (b) asset quality; (c) management; (d) earnings; (e) liquidity; (f) sensitivity to market risk.

9. INTERNAL AUDITOR. (Installation of Internal Auditor, as amended on 01-25-11 and confirmed on 01-13-11). The Internal Audit Section is being tasked to assist in the financial and operational management of the company, shall be responsible in conducting its activities in such manner, as to:

- provide the correct accountability;

- protect the company from losses and fraud, wastage and extravagance;

- develop the necessary management information.

Its primary objective is to assist the management in achieving an effective and efficient administration of its fiscal and operational functions. This objective cover two phases:

- Protective – to protect the company’s interest, including the disclosure of weaknesses and deficiencies in control standards needing correction. To attain this objective, he/she must, (a) ascertain the degree of reliability of the amounts and statistics; (b) ascertain the extent to which the monies and properties are safeguarded from losses of all kinds and are properly accounted for; (c) ascertain the extent of compliance with the established policies, regulations, plans and procedures.

- Constructive–the furtherance of the company’s interest, including the recommendation of actions to improve its performance. To achieve this objective, he/she needs to: (a) review and appraise the policies, regulations, procedures and plans in the light of related date, changing circumstances and other evidences having a bearing on their effectiveness; (b) review and appraise the internal records of the various units within the company in terms of their adequacy, efficiency and effectiveness; (c) review and appraise the performance within the framework of the policies, regulations, plans and procedures.

He/she has the authority to examine all the company’s records, books, vouchers, files and properties necessary to carry out his/her work. His/her examination and review shall in no way relieve the other persons from their primary responsibilities assigned to them.

To carry out its work, its personnel shall institute and conduct an independent review and appraisal of the accounting, financial and other operational aspects of the company’s various organizational units.

As such, he/she shall conduct periodic audit and whenever necessary, do special investigation of the records and operations of the company and keep management informed of the irregularities and unsatisfactory conditions discovered and other findings which may be of interest.

And in order to attain its objectives, internal audit personnel have to report its findings and recommendations to the responsible officials of the company. These reports will be presented in writing or verbally, according to the circumstances.

He/she shall be directly responsible for the complete reporting in each case, of all unsatisfactory conditions and deviations from the established procedures to the management.

Additionally, he/she is also expected to give constructive recommendations/suggestions regarding improvements of the procedures, during the course of his/her work.

10. OTHER OFFICERS. The Board of Directors may appoint such other officers as may be deemed necessary, provide their powers and duties, and fix their compensation.

V. Board Composition

| PANGASINAN BANK (A Rural Bank), INC. | |||||

| List of Board of Directors | |||||

| As of December 31, 2020 | |||||

| Name | Type | Principal Stockholder | No. of years as Director | No. of Shares Held | Percent to Total Shares |

| Mr. Romualdo Patrick F. Siapno | Chairman | Siapno Family | 18 | 6,262 | 1.25 |

| Arch. Mark Joseph F. Siapno | Director | Siapno Family | 18 | 5,956 | 1.19 |

| Anne Q. De Guzman | Director | De Guzman Family | 8 | 3,313 | 0.66 |

| Atty. Gerald P. Gubatan | Independent Director | Gubatan Family | 2 | 5,098 | 1.02 |

| Dennis N. Calimlim | Independent Director | Calimlim Family | 18 | 7,458 | 1.49 |

VI. Board Qualification

- At least twenty five years of age at the time of election or appointment.

- At least College graduate and have five (5) years’ experience in business.

- Have attended a special seminar for Board of Directors conducted or accredited by the BSP.

- Fit and proper for the position of a director of the bank. The following matters were considered in determining fit and proper for the position of a director:

– Integrity/probity

– Competence

– Education

– Diligence

– Experience/Training

VI. List of Board-Level Committees Including Membership and Function

- AUDIT COMMITTEE. The Audit Committee shall be composed of members of the board of directors, at least two (2) of whom shall be independent directors, including the Chairman, preferably with accounting, auditing or related financial management expertise. Duties and responsibilities are the following:

- The Audit Committee will oversee the bank’s financial reporting and control as well as the internal and external audit activities.

- It will be responsible for the setting up of the internal audit department and for the appointment of the internal auditor as well as the independent external auditor who will both report directly to the committee.

- It will monitor and evaluate/review the adequacy and effectiveness of the internal control system, including financial, operational and compliance control and that risk management, is conducted at least annually.

- The audit committee shall have explicit authority to investigate any matter within its terms of reference, full access to and cooperation by management and full discretion to invite any director or executive officer to attend its meetings, and have adequate resources to enable it to effectively discharge its functions.

VII. Directors Attendance at Board/Committee Meetings

| PANGASINAN BANK (A Rural Bank), INC. | ||||||||||||||||||||||||||||||

| Attendance at Board and Committee Meetings | ||||||||||||||||||||||||||||||

| As of December 31, 2020 | ||||||||||||||||||||||||||||||

| Name of Directors | Board Number of Meetings | Audit Committee | ||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||

| Mr. Romualdo Patrick F. Siapno | ||||||||||||||||||||||||||||||

| Arch. Mark Joseph F. Siapno | ||||||||||||||||||||||||||||||

| Anne Q. de Guzman | ||||||||||||||||||||||||||||||

| Atty. Gerald Z. Gubatan | ||||||||||||||||||||||||||||||

| Dennis N. Calimlim | ||||||||||||||||||||||||||||||

| Ma. Socorro Q. Quinto | ||||||||||||||||||||||||||||||

* Note: Atty. Gerald Z. Gubatan appointment was on April 30, 2019

IX.List of Executive Officers/Senior Management

PANGASINAN BANK (A Rural Bank), INC.

List of Executive Officers/Senior Management

As of December 31, 2020

Ms. Anne Q. de Guzman President

Mr. Edmund V. Fernandez Vice-Presidnet

General Manager

Security Officer

Remedial Officer

Ma. Socorro Q. Aquino Corporate Secretary

Chief Credit Officer

Property Mgmt. Head

Evelyn C. Vergara Compliance Officer

Dianne L. Antenorio Internal Auditor

Sebastina F. Nepacina Chief Accounting Head

Chiqui T. Ungson Acting HR Head

Melanio C. Ferreria Chief Appraiser

Gemmalyn P. Navarro Treasurer/Legal Secretary

Dinah R. Desamito Credit Risk Review Officer

IX. Performance Assessment Program

The performance appraisal policy supports the performance appraisal scheme. The scheme is a formal process centered on an annual meeting of each employee and their line manager to discuss his/her work. The purpose of the meeting is to review the previous year’s achievements and to set objectives for the following year. These should align individual employees’ goals and objectives with organizational goals and objectives.

Core Principles of the Appraisal Policy

- The appraisal process aims to improve the effectiveness of the organization by contributing to achieving a well-motivated and competent workforce

- Appraisal is an ongoing process with an annual formal meeting to review progress.

- The appraisal discussion is a two-way communication exercise to ensure that both the needs of the individual, and of the organization are being met, and will be met in the next year.

- The appraisal discussion will review the previous year’s achievement, and will set an agreed Personal Development Plan for the coming year for each member of staff.

- All directly employed employees who have completed their probationary period are required to participate in the appraisal process.

- The appraisal process will be used to identify the individual’s development needs and support the objectives of the Training and Development Policy.

- All staff will receive appraisal training as an appraisee, and where appropriate as an appraiser.

- The appraisal process will provide management with valuable data to assist succession planning.

- The appraisal process will be a fair and equitable process in line with our Equality Policy.

Performance Appraisal Implementation

Performance appraisal discussions will be held over a designated 4-week period on an annual basis. They will be arranged by the appraisee’s line manager. Line managers are encouraged to provide the opportunity for a supplemental 6-month verbal appraisal review, mid-year and other informal reviews as necessary throughout the year.

The discussion will be held in private. Information gained during the appraisal will be shared only with senior management. The exception is training needs that will be provided to the HR / administration for action. Confidentiality of appraisal will be respected.

The appraiser (usually the employee’s line manager) will be expected to have successfully completed appraiser training, and to be familiar with the appraisee’s work.

All appraisal documents should be issued to both parties prior to the discussion, in order to allow time for both parties to reflect and prepare. These will provide a framework and focus for the discussion.

A time and venue for the discussion will be advised at least one week before the meeting takes place.

The Appraisal Discussion

The appraisal discussion will allow an opportunity for both the appraisee, and the appraiser to reflect and comment on the previous year’s achievements. It will praise achievement and encourage the appraisee in his/her role.

The appraiser is accountable for giving the employee constructive, timely and honest appraisals of their performance, which should take into account both the goals of the organization and of the individual.

The discussion should be a positive dialogue, and will focus on assisting the appraisee to acquire the relevant knowledge, skills and competencies to perform his/her current role to the best of his/her abilities.

The appropriate forms will be completed and signed by both parties. The appraisee will be given the opportunity to note any comments that he/she does not agree with and complete a self-assessment.

The appraisee and line manager should agree on a Personal Development plan for the appraisee for the following year. This will reflect the appraisee’s aspirations and the organization’s requirements, and should align personal and organizational goals. The organization and the line manager will support the individual to achieve these goals during the forthcoming year.

Any training needs, future training requirements, planned qualifications, development opportunities and career planning should be discussed in the light of the Personal Development Plan.

Training and Monitoring

Senior Management are responsible for the appraisal process, and he/she shall ensure that appraisers and appraisees are adequately equipped and trained to undertake the performance appraisal.

Guidelines and Policies on Position Changes and Salary Grading

Salary Process

- Starting salary for new hires without experience shall be the minimum rates.

- Starting salary for new hires with experience, shall take into consideration the factors in the salary review:

- Applicant’s Experience: the number of years of previously worked in the industry and relevant functional experience the applicant possesses at the time of application.

- Applicant’s Education: relevant education, training and /or certifications that at least meet the minimum requirements for the job.

- Applicant’s Salary History: the salary history in positions similar to the new position or being considered as progressing towards the new position, may be taken into consideration.

- Internal equity: the skills and background of applicants should be compared to those of internal (department/division) employees performing similar work. Salary equity does not imply that all employees in similar positions who have similar years of experience and education should be paid the same salary. Recognition of varying levels of skills and performance, for example, will result in differences in salary among employees.

- Recruitment difficulties: skills in high demand or hard-to-find areas require additional salary consideration. Factors such as the scarcity of qualified applicants, the number of rejected job offers, and the turnover rate for the position may be considered.

Qualications for salary increases at mid-point rate.

- Employee must have no tardiness beyond the allowable time within a year.

- Employee must have no memos pertaining to violations of company policies and rules within 2 years.

- Employee must have passed the performance evaluation rate of at least 10 at 2 consecutive Performance Appraisal Activity.

- Employee must have a positive recommendation from his/her immediate supervisor/manager. (With attached supporting documents to justify the recommendation.)

- Employee must have passed the level of audit performance rate of least 30% as per Internal Audit System.

Qualifications for salary increases at maximum rate.

- Employee must have no tardiness beyond the allowable time within the previous 2 years.

- Employee must have no memos pertaining to violations of company policies and rules within the previous 2 years.

- Employee must have pass the performance evaluation rate of at least 10 at 3 consecutive Performance Appraisal Activity.

- Employee must have a positive recommendation of his/her immediate supervisor/manager. (With attached supporting documents to justify the recommendation.)

- Employee must have passed the level of audit performance rate of least 30% as per Internal Audit System within the previous 2 years.

Promotional Process

-when an employee moves from a position to another position that is assigned with a higher salary grade, this is considered as promotion.

Qualifications:

- He/she must already be on regular status, and full-time employee.

- Employee must be in his/her current position for at least 6 months to 2 years consecutively.

- Employee must have earned a performance rate of at least 10 during the 2years period.

- Employee must have no tardiness beyond the allowable time within a year.

- Employee must meet the required competence and requirements of the new position.

- No memos pertaining to company policies/rules violation within the past 2years.

- Employee must have no record of cash overage/shortage within a year. (for teller/cashier position).